Premier Mortgage Broker for Accountants

5/5 Star Google Reviews

Home Loans for Accountants: Use Your Financial Expertise to Save More

Numbers, balance sheets, and financial forecasts—you know them inside out. But when it comes to securing a home loan, the process isn’t always as straightforward as crunching the numbers.

The good news is that your profession can work in your favour. As an accountant, your financial stability and low-risk profile may place you in a stronger position with lenders. This could open the door to exclusive home loan benefits such as waived Lenders Mortgage Insurance (LMI), lower interest rates, and greater borrowing capacity.

At Trusted Finance Solutions, we understand the unique advantages accountants have in the mortgage market. Whether you're looking to buy your first home, upgrade, or invest in property, we’ll help you leverage your profession to secure a home loan that works for you.

Let’s explore how you can turn your career into a mortgage advantage.

Benefits of Home Loans for Accountants

As an accountant, you may be eligible for exclusive mortgage benefits, including:

1. Higher Borrowing Capacity

Accountants may qualify for higher loan amounts due to factors such as steady employment, predictable earnings, and strong financial management. This can make it easier to purchase a property in a competitive market.

2. Waived or Reduced Lender’s Mortgage Insurance (LMI)

Some lenders waive LMI for eligible accountants, even with a deposit as low as 10%. This could lead to significant savings and help you buy a home sooner.

3. Competitive Interest Rates

Some banks and lenders offer lower interest rates to accountants, as the profession is often viewed as financially stable and low risk. This could mean significant savings over the life of the loan.

4. Flexible Loan Features

Many home loans for accountants include offset accounts, redraw facilities, and flexible repayment options, allowing you to manage your mortgage efficiently and potentially reduce the interest you pay over time.

These benefits can make it easier for accountants to buy a home or invest in property, but they depend on individual circumstances and lender policies, which often vary.

Qualifying Factors for Home Loan Benefits for Accountants

Lenders offer exclusive home loan benefits to accountants based on their financial stability and professional standing. To qualify for perks such as LMI waivers, discounted interest rates, or higher borrowing capacity, you may need to meet specific eligibility criteria.

1. Membership with a Recognised Accounting Body

Lenders often require accountants to hold membership with a recognised professional accounting body to qualify for exclusive home loan benefits. This requirement helps verify your professional standing and financial stability. Being part of an industry-recognised organisation signals credibility and expertise, which could improve how lenders assess your application.

2. Minimum Income Requirements

Some banks and lenders set minimum income thresholds to qualify for LMI waivers or interest rate discounts. While income requirements may vary, a common benchmark is $90,000 or more per year. Higher earnings may further improve eligibility for premium home loan packages with lower fees and better rates.

3. Employment Type and Stability

Your employment structure can impact how lenders assess your application:

- Salaried Accountants – Lenders typically require stable full-time or part-time employment with a history of consistent earnings.

- Self-Employed Accountants – Additional documentation, such as tax returns, business financials and BAS statements, may be required to verify income and financial stability.

4. Strong Credit History and Financial Standing

A strong credit score and responsible financial management can improve your chances of accessing favourable mortgage terms. Lenders will review your credit report, existing debts, and repayment history to assess your borrowing capacity. Ensuring your financial position is strong before applying may help you access more competitive home loan options.

Which Industry Memberships Are Recognised?

Commonly recognised memberships include well-established professional accounting and finance organisations that reflect industry standards and credibility. These may include:

- CPA Australia, along with recognised partner bodies

- Chartered Accountants Australia & New Zealand (CA ANZ), including the Global Accounting Alliance

- Chartered Financial Analyst Institute (CFA Australia)

- Institute of Public Accountants (IPA)

- Other relevant industry bodies, like the Fellowship of the Institute of Actuaries of Australia (FIAA), may also be accepted on a case-by-case basis.

What’s an Acceptable Form of Evidence of Membership?

Lenders usually require proof of current membership with a recognised industry body to confirm your professional status. Acceptable evidence may include:

- Receipt for payment of annual membership

- Current valid membership card

- Written confirmation from the listed association

- Practising Certificate

LMI Waivers for Accountants

One of the biggest advantages available to accountants is the potential to avoid Lender’s Mortgage Insurance (LMI).

1. How LMI Waivers Work

Lenders Mortgage Insurance (LMI) is usually required when a borrower has less than a 20 per cent deposit. However, some lenders waive this requirement for accountants who meet specific criteria. This allows eligible applicants to secure a loan with a smaller deposit without the added cost of LMI.

2. Eligibility Criteria for an LMI Waiver

LMI waivers for accountants are typically offered to applicants who meet certain professional and financial standards. These may include current employment in an approved role, recognised industry accreditation, a minimum income level, and a loan-to-value ratio within the lender’s accepted range.

The specific criteria can differ between lenders, but generally, applicants must demonstrate financial stability and professional standing to qualify.

3. What Is the Minimum Income Required for Waived LMI?

Many lenders set a minimum income threshold when offering professional home loans for accountants with waived LMI. While this can vary between institutions, a common benchmark is an annual income of $150,000 or more, either individually or combined (if applying jointly).

Some lenders may have slightly different thresholds depending on your location, employment type, or other financial factors.

4. Which Occupations Are Eligible for the LMI Waiver?

You’ll need to be currently employed in one of the following professions:

- Accountant

- Actuary

- Auditor

- Chief Financial Officer

- Director

- Finance Director

- Finance Manager

- Financial Controller

- Partner

5. Which Banks Waive LMI for Accountants?

Several major Australian banks recognise accountants as low-risk borrowers and offer tailored home loan benefits as part of their professional packages. Here’s an overview of some lenders offering favourable terms for accountants:

- CBA LMI waiver for accountants – Commonwealth Bank may offer LMI waivers for eligible accountants with as little as a 10% deposit, provided certain income and accreditation requirements are met.

- NAB LMI waiver for accountants – NAB is known to support professionals through its tailored lending policies, which can include waived LMI for qualified accountants.

- Westpac LMI waiver for accountants– Westpac often includes accountants in its professional loan offerings, with LMI waivers and higher borrowing limits for approved applicants.

- ANZ LMI waiver for accountants– ANZ also provides LMI exemptions to accountants who meet its income and industry membership criteria.

In addition to the big four banks, several non-bank lenders and specialist institutions may also offer competitive deals for accountants, depending on your individual circumstances. These offers are often not publicly advertised, so speaking with a mortgage broker for accountants can help you uncover options that may not be immediately visible.

Not sure what offers are actually available to you? A mortgage broker can help you uncover the right options—reach out today!

LMI Waivers for Partners in Accounting Firms

Partners in accounting firms may still qualify for waived LMI, though lenders often assess their income differently due to business structures. Instead of a standard salary, income from profit distributions or partnership shares usually requires additional documentation. Lenders typically look for stable income over two years, professional accreditation, and minimum income thresholds.

Which Firms Qualify for Reduced Income Verification?

Some lenders offer reduced income verification for professionals working at recognised firms, meaning less documentation may be required when applying for a home loan. Commonly accepted firms include:

- Ernst & Young (EY)

- KPMG

- PwC

- Deloitte

- Grant Thornton

- PKF

- McGrath Nicol

- Minter Ellison

- Allens Arthur Robinson

- Gadens

- Henry Davis York

- Corrs Chambers Westgarth

- Freehills

- Mallesons Stephen Jaques

- Clayton Utz

How Much Can an Accountant Borrow?

As an accountant, your strong financial position may open the door to higher borrowing limits. Depending on your circumstances and the lender, you may be able to:

- Borrow up to 90% with no LMI for accountants

- In some cases, up to 95% without LMI, subject to stricter criteria

- Borrow 100% to 105% with a guarantor

- Access loans of up to $2.7 million, though most lenders cap this around $2 million for a home or investment property.

Keep in mind that borrowing limits can vary significantly between lenders. Factors such as income type, financial history, and existing debts all play a role in how much you can borrow.

Curious about how much you could borrow? Use our borrowing power calculator to get an estimate or reach out to our mortgage brokers in Melbourne for personalised guidance.

Home Loan Options for Accountants

Accountants can access home loan options designed to suit their financial stability and career growth. Here are some of the most common mortgage options available to accountants in Australia:

1. Investment Property Loans for Accountants

If you're considering property investment, investment home loans provide tailored features such as interest-only repayments and access to potential tax benefits like negative gearing. Accountants often qualify for higher borrowing amounts due to their stable income, which can help them build a strong property portfolio over time.

2. Low-Doc Home Loans for Self-Employed Accountants

Self-employed accountants or those operating as sole traders, partners, or company directors may face challenges when proving income through traditional means. Low-doc home loans allow accountants to apply using alternative income verification methods, such as BAS statements, bank statements, or accountant declarations, making it easier to secure a mortgage without extensive financial documentation.

3. Low Deposit Home Loans for Accountants

Low-deposit home loans can be a suitable option for accountants who haven’t saved a large deposit. Some Australian lenders accept deposits as low as 5 to 10 per cent and may offer additional benefits such as waived LMI on loans covering up to 90 to 95 per cent of the property’s value.

In addition, eligible first-home buyers may be able to access government grants or schemes, such as the First Home Guarantee, which helps reduce the upfront deposit required.

4. Fixed vs. Variable Rate Loans

When selecting a mortgage, accountants can choose between fixed-rate loans for stability or variable-rate loans for flexibility:

- Fixed-Rate Loans – Offer predictable repayments, protecting against interest rate rises. This may be suitable for accountants who prefer financial certainty.

- Variable-Rate Loans – Provide flexibility, allowing for extra repayments and potential savings if interest rates decrease. This may suit accountants with fluctuating cash flow.

- Split Loans – Uses both fixed and variable rates to give you stable and flexible repayments.

5. Refinancing Options for Accountants

Refinancing could be a useful option for accountants aiming to lower repayments, access equity, or adjust their loan structure based on current needs. With stable income and strong financial awareness, accountants are often well-positioned to secure better rates, switch between fixed and variable options, or consolidate debt. If your property has increased in value or your financial situation has improved, refinancing could also help reduce or remove LMI.

How to Get the Best Home Loan as an Accountant

To make the most of your position as an accountant, here are a few practical steps to help you secure a competitive home loan:

1. Speak with a Mortgage Broker for Accountants

A broker familiar with accountant-specific lending policies can connect you with lenders offering waived LMI, better rates, and higher borrowing limits.

2. Prepare Your Financial Documentation

Have recent payslips, tax returns, or partnership income details ready, depending on your employment structure.

3. Ensure Your Industry Membership Is Recognised

Membership with bodies like CA ANZ, CPA, or IPA is often required to access professional loan benefits.

4. Understand Your Borrowing Power

Knowing how much you can borrow helps set realistic goals and identify lenders who offer favourable terms based on your income and deposit.

5. Review Your Credit and Financial Position

Having good credit and low debt can make your application stronger and increase the likelihood of approval.

Following these steps can help you access better terms, fewer upfront costs, and a loan structure that suits your goals.

Ready to make your next move with confidence? As your premier mortgage broker in Moonee Ponds, we understand what accountants need and will guide you through every step. Reach out today to get started.

You Work Hard Managing Finances—Now Let’s Get Yours in Order

You already help others make smart financial decisions every day. As an accountant, your stable income, strong financial profile, and industry accreditation place you in a unique position to access home loan benefits that are not available to everyone.

At Trusted Finance Solutions, we understand the nature of your profession and how lenders assess it. Whether you are employed, running your own practice, or working as a partner, we know how to present your financial situation clearly and effectively. From waived LMI to flexible loan options, we ensure your home loan reflects the financial strength and stability that comes with your role.

You help others make smart financial moves every day. Contact us today to make one for yourself.

The Mortgage Expertise You Deserve, Delivered with a Personal Touch

At Trusted Finance Solutions, we offer a premium mortgage brokerage service that takes the stress out of securing finance. We handle everything from start to finish, ensuring a seamless experience with expert guidance at every step. With access to over 40 lenders, our award-winning brokers secure competitive rates and structured loans, so you can focus on what matters while we take care of the rest.

Speak to a Senior Finance Broker

We’re excited to assist you in securing the perfect loan. New clients can conveniently apply online anytime, while existing clients are encouraged to call us for personalized support and expedited processing.

Personalised Mortgage Solutions

Every client has unique financial goals, and we take the time to understand your situation to find the best mortgage solution for you. Whether you're a first home buyer, an investor, or looking to refinance, we provide expert advice tailored to your needs. Our commitment is to guide you through every step, ensuring a smooth and stress-free journey to home ownership.

✔️ Expertise That Matters: Our team comprises seasoned mortgage brokers in Melbourne who have a deep understanding of the ever-changing finance industry. We stay up-to-date with the latest market trends and lending practices, ensuring you receive the most current and relevant advice.

✔️ Unbiased Guidance: As independent mortgage brokers, our loyalty lies with you, the client. We are not affiliated with any specific lender, which means our recommendations are unbiased and solely focused on what suits your needs.

✔️ Seamless Process: Navigating the world of mortgages and finance can be complex, but we make it easy for you. From the initial consultation to the final settlement, we guide you through each step, clarifying any queries you might have along the way.

✔️ Extensive Network: With years of experience as finance brokers in Melbourne, we have built strong relationships with lenders, banks, and financial institutions. This network allows us to negotiate competitive rates and terms on your behalf.

Meet Our Senior Finance Brokers

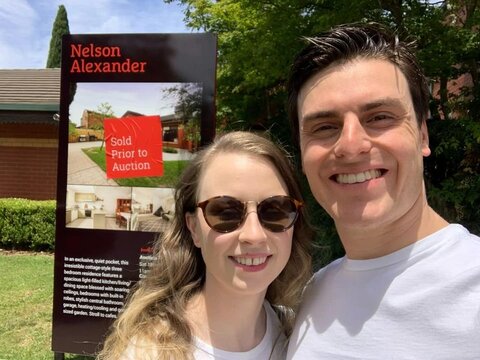

Daryn Heffernan

Mortgage Broker, Finance Strategist

Meet Daryn

Ian Smith

Finance Specialist

Meet Ian Smith

Sian Cutter

Office Manager

Meet Sian

Kartika Heffernan

Director

Meet Kartika

Richard Katan

Business Development Manager

Meet Richard

Ellana Berslaes

Broker Assistant

Meet Ellana

Kimberly Miles

Client Service Specialist

Meet Kimberly

Tracey Dean

Post Settlement Client Manager

Meet TraceyGet to Know more about us

Office Hours

- Monday 8:30 AM - 5:00 PM

- Tuesday 8:30 AM - 5:00 PM

- Wednesday 8:30 AM - 5:00 PM

- Thursday 8:30 AM - 5:00 PM

- Friday 8:30 AM - 5:00 PM

Professional Home Loans

Investment Property Loan

Leverage your current financial position to expand your investment portfolio and achieve greater financial security.

Why Use Our Brokers Instead of Going Directly to Your Bank?

Choose Trusted Finance Solutions to receive a tailored loan that aligns perfectly with your current and future financial goals, thanks to our personalised assessment and expertise. Unlike banks, we prioritise your financial well-being and navigate the complexities to ensure you get the best deal available.

- Thorough Assessment: We thoroughly assess your situation to provide a comprehensive lending solution.

- Future Consideration: Our brokers consider both your current needs and future goals.

- Best Possible Loan: We ensure you receive the best possible loan tailored to your unique requirements.

- Personal Representation: Brokers work on your behalf to arrange a home loan through a bank or lender.

- Policy Navigation: They navigate the different policies and loan requirements of Australian banks and lenders.

- Tailored Solutions: Brokers find the loan that best fits your individual situation.

Applying directly to a lender:

Quantity Over Quality: Many banks prioritise meeting quotas over your financial future.

Limited Options: Lenders can only offer a limited range of loan products.

Complex Policies: The complexity of mortgage applications means even bank staff may not fully understand their own policies, leading to delays or unnecessary declines.

Why Us

Award-Winning Mortgage Brokers

Recognised among Australia’s top mortgage brokers, earning multiple industry awards.

25+ Years of Experience

With decades of industry expertise and a keen eye for smart investments, our founder is dedicated to finding the best financial solutions tailored to your needs.

Clear & Client-Focused Solutions

Complimentary Consultation: Gain expert advice with zero commitment.

Strategic Mortgage Planning: Crafted to fit your financial ambitions.

Seamless Support: We oversee the entire process, from application to settlement.

Smarter Loans, Better Homes

Whether you're a first-home buyer, property investor, or a professional in need of specialised financing, we simplify the journey and secure market-leading rates.

Sydney’s Most Trusted Mortgage Specialists

With over 320 five-star client reviews, our Sydney-based team delivers personalised, one-on-one mortgage guidance at every step of your journey.

Accredited & Respected in the Industry

Endorsed by MFAA & FBAA, our certifications reflect our commitment to integrity, expertise, and excellence in mortgage services.

Fully Licensed & Compliance Assured

We expertly navigate complex lending requirements, ensuring a smooth and compliant financing experience aligned with all regulations.

Take the First Step – Speak to an Expert Broker

Call Now: 03 8371 0027 for a no-obligation consultation and start securing the best mortgage solution for your needs.

Tailored Financial Strategies for Every Goal

Our expert guidance is customised to suit your financial objectives—whether you're purchasing your first home, growing an investment portfolio, or refinancing for better terms.

Banks vs. Trusted Finance Solutions – The Smarter Choice

See how Trusted Finance Solutions outperforms traditional banks with personalised service, diverse lending options, and a commitment to putting clients first.

Traditional Banks

Customers are treated as just another number in the system.

vs

Trusted Finance Solutions

Clients receive personalised service with tailored financial solutions.

Limited loan options with rigid policies.

vs

Access to 40+ lenders with a variety of flexible mortgage solutions.

Slow approval times with complicated processes.

vs

Fast-tracked applications with hands-on guidance.

Focus on maximising profits for the bank.

vs

We prioritise your financial goals and best interests.

Generic mortgage plans that lack flexibility.

vs

Custom-built strategies designed for your unique financial situation.

Call centers with minimal personal engagement.

vs

A dedicated broker guiding you every step of the way.

Mortgage & Finance Calculators

Use our easy-to-use calculators to plan your financial future.

We compare hundreds of loans in the marketplace and provide credit assistance along the way.

When it comes to finding reliable and knowledgeable mortgage brokers in Melbourne, Trusted Finance Solutions stands out as your go-to solution. With a range of services that cater to various financial needs and a team of experts who genuinely care about your success, we are committed to guiding you through the intricacies of the finance and mortgage landscape.

We assist Australians in securing investment loan approvals quickly and smoothly.

Secure The Best Investment Loan Within 24 Hours!

Access our premium broker to benefit from lower interest rates & swift approval.